The purpose of creating a budget is to get a clear picture of how your income is spent and the frequency. Understanding this picture will help you make decisions that will minimize expenses and maximize income for a well-managed household budget. As the CEO of your household corporation it is your job to create opportunities that promote generational wealth. Here are some tips that can help guide you along your journey.

Tip #1: Create a Well-Managed Budget

The first tip to creating a well-managed household budget is to identify all sources of income and know on what day that money is applied to your bank account. Do not consider a banking deposit transaction in “pending” status as applied. Until the transaction is updated to “posted,” those funds are controlled by the bank and not available to you for use. Adopting this mindset will help you avoid costly nonsufficient fund (NSF) fees.

Tip #2: Rounding Down Income Amounts

The second tip is to round down when recording income amounts on your budget. For example, your income for this month is $2,845.17. Record the amount of $2,800 on your budget to provide a “buffer” to against NSF fees on small purchases under $50. Have you ever received a $35 NSF fee on a $10 transaction? This buffer method reinforces the avoidance of costly NSF fees.

Tip #3: Allocate Your Income by Category

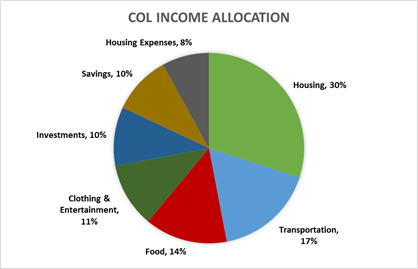

The third tip is to allocate how your income SHOULD be spent by category. In this process you will take the amount you receive from your paycheck (Net) and subtract your tithes (10% of Gross) to get your Cost of Living (COL) Income amount. Take the COL Income amount and multiply it by the percentage you have assigned by category. See the below pie chart as an example. The total of all categories must equal 100% of the COL Income amount. There is no right or wrong way to allocate your category percentages however remember that the goal of a well-managed household budget is to minimize expenses and maximize income. If you need assistance creating your budget, please contact Dr. GNP.

Written by:

DR. GNP

ADVISE | TEACH | GOVERN

jennoa.graham@gmail.com | www.drgnp.com

For more information about budgeting and organizing your finances, contact Dr. GNP today!

Have a comment? Share below! We’d love to hear from you!

Those were great budgeting tips that I will have to start implementing into my daily life. Thank you! ICYB

Wonderful! Be sure to share your progress!

This was very helpful. I never considered rounding down. We will definitely be implanting this. ICYB.

Outstanding! Thanks for sharing. Share this blog post with others and be sure to come back and share how these tips are helping you!